Hot after signing a fresh US$30 million external debt addition by peddling junk bonds to the international capital market, the government announced this week that it had signed an agreement with a Chinese company to install additional electricity generating capacity to the tune of US$26 million. The money to pay for the project is being provided by the ExIm Bank of

Government PR exercise on state broadcasting media as well as the state controlled Seychelles Nation concentrated on the government’s admission that the current electricity generating capacity has been inadequate for some time now. What has been deliberately hidden from the public was the fact that the project would add another $26 million dollars to the total external debt of the country.

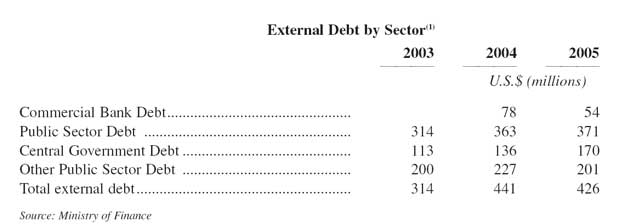

The total external debts incurred by the public sector alone, as collated by the Ministry of Finance, shows that the figure has reached the incredible sum of US$514,000,000 in foreign currency debts outstanding as at 31 December, 2006. This amount is an increase from US$426m outstanding at December 2005. While this information has been made available to the rest of the world, here in

The total outstanding external debt of the public sector at the end of 2006 includes the US$200m of junk bonds sold in October last year. That does not include the additional US$30m new junk bonds sold in 2007. According to the Ministry of Finance, of the US$426m dollar of public sector external debt outstanding at 31 December 2005, the parastatals accounted for US$ 371m, with the Government accounting for US$ 170m while another US$201m has been incurred by other public sector institutions.

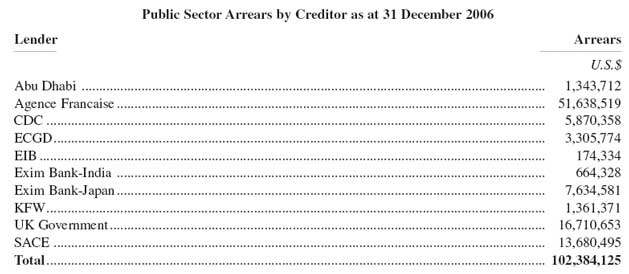

Although President Michel has been boasting on state broadcasting media that the proceeds of the junk bonds issued last year have been used to clear some external debt arrears, the Ministry of Finance has been quietly letting it known that in reality, over US$102m of external debts were still in arrears as at the end of December 2006. The biggest chunk of arrears is to the French Government’s development agency (US$51m). Past French governments have ignored the non-payment of debts for geopolitical reasons. It remains to be seen if President Nicholas Sarkozy will take the same approach.

ECGD – Export Credit Guarantee Department is the

SACE is the Italian provider of credit insurance for international trade.

EIB – European Investment Bank.

The Government has yet to announce the terms of the financing of the new electricity generators which will be housed at Roche Caiman. The new debts, however, will raise serious doubt about the government’s stated intention to international investors that we would be able to reduce total public sector external debt from its current high ratio of 66% to GDP

The irony of the new foreign currency debts to finance additional electricity generators to supply the west of Mahe with power, is that the Minister of Finance Danny Faure had only recently tried to give the impression that foreign direct investments (FDI) would come to his rescue. In fact the additional power is needed to supply electricity to the new hotels, one more heavy price we have to pay to attract foreign direct investments.