THE rate of inflation during the month of March was officially 12.3%. Yes and no, says the National Statistics Bureau (NSB) which released the latest figures last week. Yes, if you consider that the 12.3% figure was based on prices of goods that the statisticians could find in the shops. Two items that were in short supply when the statisticians went shopping in January for example were butter and margarine. So their prices could not be included in the index. Its stands to reason that one cannot measure the increase in price of nothing. So NSB says, take this latest figure on inflation with a pinch of salt.

The official rate of inflation used to be much lower. You may wonder how the statisticians came up with such ridiculous low inflation figures in the past when everyone knew first hand from our daily shopping experiences, that prices of goods have risen almost daily and exponentially in Seychelles. Don't our statisticians know of a supermarket by the name of Super Save? Didn't they go there to get butter at least once when SMB didn't have any? The IMF constantly complained that the inflation figures published by NSB in the past did not reflect the true cost of living influenced by the black market in currency exchange. So what has changed to make the figures in line with the reality this year? For one, SMB is no longer and its successor seems to rely on the black market to obtain foreign exchange.

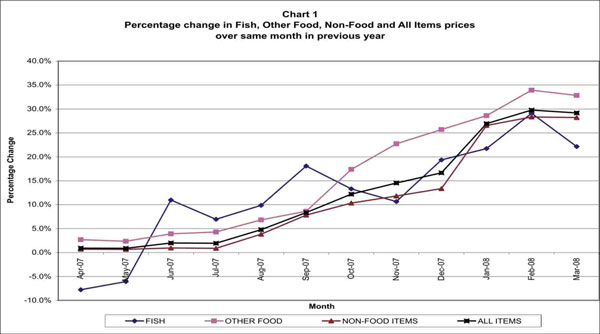

The statisticians don't just buy anything and then calculate the inflation rate from their prices. In fact inflation index is not really the measure of the real cost of living that one experiences on a day to day basis. Inflation measurement is sophisticated mathematics that tries to measure the underlying increase in prices of a large enough basket of goods over a twelve month period, not just one or two items, which is our daily buying habit. For example, the price of fish may be higher in two out of twelve months. So the shopper may decide to buy cheaper alternatives to fish during that period of higher fish prices. This behaviour mitigates on the cost of living for the average family budget. Hence to smooth out the ups and downs in order to get a picture of the trend, statisticians use the average of the consumer price index or CPI (Consumer Price Index) as their indicator.

The CPI for its part, tracks prices of a basket of goods and services which statisticians claim represent the expenditures of an average household during a month. But how do they know what you and me buy? Well, they don't but they try to get the best picture possible. To do this they chose a statistical sample of households at random and ask them to write down everything they buy every day over the months of May 2006 to July 2007. From these records they figured out the proportion of the spending (as a percentage of the total spending) a typical household makes on a list of goods and services. This percentage becomes the “weight” in the mathematical formulae to calculate the CPI. It is from this index that inflation rate is derived.

In Seychelles, the statistician's lives have been complicated because of SMB. For years SMB was been the monopoly supplier of imported essential goods to the whole of Seychelles, minus Gregoire's supermarket on La Digue. And SMB practiced price fixing on an obscene scale. In fact prices have literally been fixed to the ceiling for years. So when a basket of goods is concocted, however scientifically, the price fixing practice of SMB distorted or rather flattened the figures. However, even though today SMB or its successor STC no longer enjoys a monopoly on importation of essential goods the statisticians, it seems continue to rely on STC prices. So when STC does not have the product to sell, which is becoming more frequent, the inflation rate figures get skewed. Perhaps NSB should have one index inclusive of STC prices and another based on prices of goods sold by such well know supermarkets like the People's Supermarket and Super Save.

Nevertheless, the month on month CPI figures published by NSB shows just how government decisions alone have caused the sudden increase in the cost of living. In January 2007 the All Items index was 97.8 but in January 2008 the index shot up to 124.1, an increase of 26.9%. For March, it has shot up to 29.2%. Bear in mind that in 2007 SMB was subsidised by the government in a bid to keep the price increases down. Worse for the average household has been the increase in the cost of electricity, water and cooking gas, which has shot up by 47% between December 2006 and January 2007.

In fact the prices of all the categories of goods supposedly bought by the average household in Seychelles shot up by double digit figures between January of last year and January of this year according to the NSB statistics. Yet, according to businessman Radley Weber (who runs the Docklands Super Market) the CIF import prices of the goods arriving between September and December barely changed, but the black market in foreign exchange coupled with the control (limit) on the margin of profit and silly idea of charging GST on a fictitious price at the port, which combine to increase the selling price of goods two or three folds.

Hold on to your hats. Things are expected to get worse as the new entity created from the ashes of SMB is expected to follow commercial principles and pass on all the costs to consumers. Worse, the Minister of Finance in his infinite wisdom has decided that to maintain profit margin control (limit) on imported essential goods, which means that importers will have to continue the practice of over-invoicing in order to recover their rupee exposure to the black market. And this will apply to new state trading company as well.