What Is A Sovereign Credit Rating?

Before you decide whether to invest into a debt security from a company or foreign country, you must determine whether the prospective entity will be able to meet its obligations. A ratings company can help you do this. Providing independent objective assessments of the credit worthiness of companies and countries, a credit ratings company helps investors decide how risky it is to invest money in a certain country and/or security.

Credit in the Investment World

As investment opportunities become more global and diverse, it is difficult to decide not only which companies but also which countries are good investment opportunities. There are advantages to investing in foreign markets, but the risks associated with sending money abroad are considerably higher than those associated with investing in your own domestic market. It is important to gain insight into different investment environments but also to understand the risks and advantages these environments pose. Measuring the ability and willingness of an entity - which could be a person, a corporation, a security or a country - to keep its financial commitments or its debt, credit ratings are essential tools for helping you make some investment decisions.

The Raters

There are three top agencies that deal in credit ratings for the investment world. These are: Moody’s, Standard and Poor’s (S&P’s) and Fitch IBCA. Each of these agencies aim to provide a rating system to help investors determine the risk associated with investing in a specific company, investing instrument or market.

Ratings can be assigned to short-term and long-term debt obligations as well as securities, loans, preferred stock and insurance companies. Long-term credit ratings tend to be more indicative of a country’s investment surroundings and/or a company’s ability to honor its debt responsibilities.

For a government or company it is sometimes easier to pay back local-currency obligations than it is to pay foreign-currency obligations. The ratings therefore assess an entity’s ability to pay debts in both foreign and local currencies. A lack of foreign reserves, for example, may warrant a lower rating for those obligations a country made in foreign currency.

It is important to note that ratings are not equal to or the same as buy, sell or hold recommendations. Ratings are rather a measure of an entity’s ability and willingness to repay debt.

The Ratings Are In

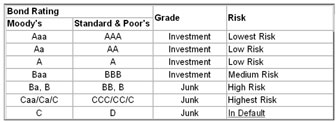

The ratings lie on a spectrum ranging between highest credit quality on one end and default or “junk” on the other. Long–term credit ratings are denoted with a letter: a triple A (AAA) is the highest credit quality, and C or D (depending on the agency issuing the rating) is the lowest or junk quality. Within this spectrum there are different degrees of each rating, which are, depending on the agency, sometimes denoted by a plus or negative sign or a number.

Thus, for Fitch IBCA, a “AAA” rating signifies the highest investment grade and means that there is very low credit risk. “AA” represents very high credit quality; “A” means high credit quality, and “BBB” is good credit quality. These ratings are considered to be investment grade, which means that the security or the entity being rated carries a level of quality that many institutions require when considering overseas investments.

Ratings that fall under “BBB” are considered to be speculative or junk. Thus for Moody’s a Ba2 would be a speculative grade rating while for S&P’s, a “D” denotes default of junk bond status.

Here is a chart that gives an overview of the different ratings symbols that Moody’s and Standard and Poor’s issue:

Sovereign Credit Ratings

As previously mentioned, a rating can refer to an entity’s specific financial obligation or to its general creditworthiness. A sovereign credit rating provides the latter as it signifies a country’s overall ability to provide a secure investment environment. This rating reflects factors such as a country’s economic status, transparency in the capital market, levels of public and private investment flows, foreign direct investment, foreign currency reserves, political stability, or the ability for a country’s economy to remain stable despite political change.

Because it is the doorway into a country’s investment atmosphere, the sovereign rating is the first thing most institutional investors will look at when making a decision to invest money abroad. This rating gives the investor an immediate understanding of the level of risk associated with investing in the country. A country with a sovereign rating will therefore get more attention than one without. So to attract foreign money, most countries will strive to obtain a sovereign rating and they will strive even more so to reach investment grade. In most circumstances, a country’s sovereign credit rating will be its upper limit of credit ratings.

Conclusion

A credit rating is a useful tool not only for the investor, but also for the entities looking for investors. An investment grade rating can put a security, company or country on the global radar, attracting foreign money and boosting a nation’s economy. Indeed, for emerging market economies, the credit rating is key to showing their worthiness of money from foreign investors. And because the credit rating acts to facilitate investments, many countries and companies will strive to maintain and improve their ratings, hence ensuring a stable political environment and a more transparent capital market.