IS THE CENTRAL BANK GOVERNOR MISLEADING THE PUBLIC?

As predicted by in this newspaper, the Central Bank of Seychelles has abandoned the publication of a September-December 2006 Quarterly Review so that it could come out with an annual report for the whole year just in time for the elections. This is a repeat performance of last year when it also failed to produce the last Quarterly Review preferring to produce an Annual Report for the year, just in time for the Presidential Election campaign.

This year the official date of release of the annual report was 25 March, after President Michel had dissolved the National Assembly and the Electoral Commissioner had set the dates for elections. As predicted the Governor, Mr Francis Chang Leng, appeared on the State broadcasting media (SBC) to pronounce that the economy is in doing as well as can be expected.

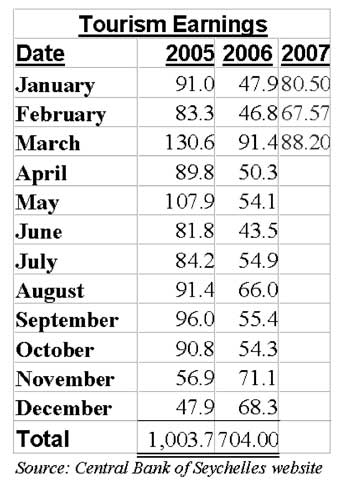

Mr Chang Leng, however, made an assertion on the amount of foreign exchange earned from the tourism industry, which appears at odds with the figures published by the Central Bank on its website. On television, Chang Leng claimed that official tourism earnings for the year 2006 under review were in excess of SR 1,251 million. The same claim is contained in the annual report itself in the section entitled “highlights of the

Yet our table, which is compiled from the monthly figures published on the website, shows that the aggregate or total official tourism earnings for 2006 was SR 704 million, some SR 500 million short compared to 2005. Indeed, for the first 3 months of 2007, tourism earnings are well below that of 2005 though slightly better than 2006. The question is which one is the truth? Or is the Central Bank hiding the fact that the five star establishments which are permitted to retain most of their foreign exchange earnings, has been earning the difference?

Yet our table, which is compiled from the monthly figures published on the website, shows that the aggregate or total official tourism earnings for 2006 was SR 704 million, some SR 500 million short compared to 2005. Indeed, for the first 3 months of 2007, tourism earnings are well below that of 2005 though slightly better than 2006. The question is which one is the truth? Or is the Central Bank hiding the fact that the five star establishments which are permitted to retain most of their foreign exchange earnings, has been earning the difference?

We want to believe that the real figures are the raw data published on the website by the bank’s own statistician. Explaining these figures, as the language of Annual Report shows, tend to skew the trend in favour of the government. Yet, however much the writer of the report tries, some facts defy false or skewed interpretations. For example, the report admitted that in 2006 the commercial banks were holding back foreign exchange in order that they could service their own foreign currency borrowings from their parent companies, which were in arrears. This belated admission does not enhance the Central Bank’s credibility.

The report also throws cold water on any hope that the SEPEC tankers will be able to assist in bringing home much needed foreign exchange in a “few years to come”. This comment comes amid serious concerns that meanwhile, our ability to be able to fund the US$50 million needed this year to import the fuel consumed in the domestic economy is in question. On this issue the report said: “To secure supplies and by implication, the very existence of the country, considerable diversion of scarce foreign exchange resources out of the financial system will be necessary to fund this national requirement thus leaving an equivalent less available for supporting the economic recovery.” This kind of language extols the extent of the concerns of someone who knows his or her economics compared to the Governor. Of course, the review did not mention that in addition the government has to come up with the US$18 million each year to service the international bond. That too “will leave an equivalent less available for supporting the economic recovery process”.

What more, the report says, “Today, despite recent gains in the macroeconomic stabilisation, the country remains vulnerable to economic shocks, notably in regard to sharp movements in interest and exchange rates. From a balance sheet perspective, both the public and private sectors are at risk, depending on their respective levels of external and internal exposure”. In nonprofessional’s term, this means that if something drastic were to happen that stops the existing flow of foreign exchange for even a short period, the economy of little

In other words, in spite of what President Michel and Governor Chang Leng are saying, the economic castle is sitting on sand and the tide is rising.