The Air Seychelles Investigation

Part 4: A J Shah replies

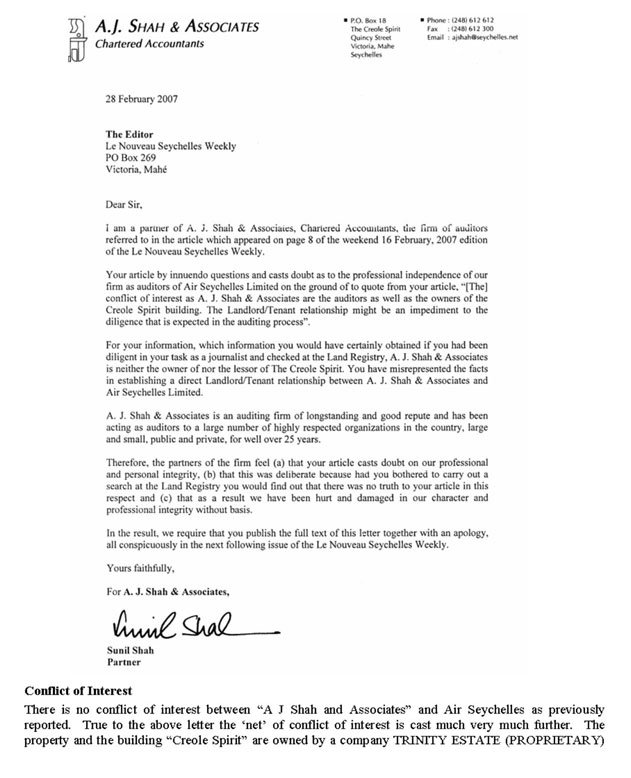

The Auditors of Air Seychelles have replied with a letter dated 28 February 2007. A full text of the letter is reproduced below:

Conflict of Interest

There is no conflict of interest between “A J Shah and Associates” and Air Seychelles as previously reported. True to the above letter the ‘net’ of conflict of interest is cast much very much wider The property and the building “Creole Spirit” are owned by a company TRINITY ESTATE (PROPRIETARY) LIMITED. This company has as it directors Mr. Anant Jivan Shah and Mr. Sunil Shah. The Memorandum of Association of this company lists two shareholders. They are Mr. Anant Jivan Shah and his son Mr. Sunil Shah. They each hold 50 shares in the company. The conflict of interest can now be summarized by that a Senior Partner (Anant Jivan Shah) and a Partner (Sunil Shah) of the Audit firm, A.J. Shah and Associates, have a non-audit interest for financial gain with Air Seychelles. The Auditor General Mr. Marc Benstrong, the Attorney General Mr. Tony Fernando, the Principal Secretary of Finance Mrs. Leka Nair, the Seychelles National Assembly Public Accounts Committee, the Head of Parastatals Committee and the Board Members of Air Seychelles remain conspicuously silent on this subject. Where were they when these state of affairs (conflict of interest) occurred, and most importantly where are they now?

Auditor Independence

Auditor Independence is freedom from pressures and other factors—indicated by certain activities or relationships—that may impair, or may be perceived to impair, the willingness of auditors, both individually and as a group, to exercise appropriate personal attributes (including objectivity and integrity) when performing an audit. Auditor independence is considered extremely important as a measurement of Transparency, Accountability and Good Governance. All professional accounting bodies have clear and strict guidelines with respect to Auditor’s independence. This is even more so with regards to Public Companies such as Air Seychelles. An example being that since 1933 the Securities and Exchange Commission (SEC) and its counterpart The Federal Trade Commission (FTC) do not consider auditors to be independent if they served as officers or directors of or had any direct or indirect interests in, public audit clients. Under this definition A. J. Shah and Associates have a conflict of interest in Air Seychelles and are not independent. The concern is that these client relations will subconsciously impair the auditor’s objectivity. This in effect introduced the appearance, as well as the fact of independence as an independence concept.

Accounting Standards

In the USA accounting standards for public companies are set by the SEC. With respect to Financial Reporting the SEC have Generally Approved Accounting Principles – US GAAP. The US GAAP are further detailed in Financial Accounting Standards issued by the Financial Accounting Standards Board (FASB). The SEC is a member of the International Organization of Securities Commissions (IOSCO) and is the most influential of the IOSCO members. The United States historically has refused to permit filings made in compliance with non-U.S. GAAP, unless reconciliations to U.S. GAAP are also included. The feeling has been that the U.S. standards, currently set principally by FASB, are the world’s most comprehensive and highest quality, and that to permit foreign registrants (or even, potentially, domestic ones) to use less stringent reporting standards would mean “tilting” the playing field and placing U.S. investors at risk. The FASB had been active in promoting the superiority of U.S. standards, citing the vastly greater resources it committed to standards development, its more formalized system of “due process”. The SEC is part of the International Accounting Standards Board (IASB), a group of International Professional Accountancy Bodies charged with issuing International Financial Reporting Standards (IFRS).

Operating vs Financial leases

With respect to accounting for leases the SEC distinguishes, amongst others, two types of leases. These leases are classified as either financial leases or operating leases. The FASBoard have issue a standard on accounting for leases: FAS 13. Therein, a lease is classified as a finance lease when it transfers substantially all the risks and rewards incidental to ownership. This means that with a finance lease the body paying the lease has the right of ownership over the asset that is being leased. A lease is classified as an operating lease if it does not transfer substantially all the risks and rewards incidental to ownership. Hence with an operating lease the body paying the lease does not own the asset being paid for. The accounting treatments for these two types of leases are very different.

Air Seychelles Leases

FAS 13 states that a finance lease is one where the “the lease transfers ownership of the property to the lessee by the end of the lease term.” In the case of Air Seychelles ownership is not transferred at the end of the lease period. The lease period ends in 2011 and Air Seychelles will only assume ownership by “making a down payment of USD 34.5 million (equivalent to € 27 million).” Therefore if, at the end of the lease period, Air Seychelles does not make this payment it does not own the aircraft. During the period of the lease payments Air Seychelles does not own the aircraft – it is renting the aircraft.

The Air Seychelles Annual Report 2005 – 2006 further states that “The ownership of the Air remains with International Lease Finance Corporation during the lease period”. When this is taken in the context of International Accounting Standards which state “The classification of leases …is based on the extent to which risks and rewards incidental to ownership of a leased asset lie with the lessor or the lessee. A lease is classified as a finance lease if it transfers substantially all the risks and rewards incidental to ownership. A lease is classified as an operating lease if it does not transfer substantially all the risks and rewards incidental to ownership.”

Ownership under leases

Under FAS 13 this distinction (between finance and operating leases) becomes clearer when the body undertaking the lease gives a reasonable assurance of its ability to purchase the asset at the end of lease period. As revealed last week Air Seychelles is not able to pay its debt’s. In this financial situation Air Seychelles will not be in a position to make the down payment on the air craft. How does Air Seychelles give a reasonable assurance of its ability to pay for the lease? The only answer is through a third-party guarantee. This can only be the Government of Seychelles.

Accounting Treatment of Leases

Finance leases are capitalized in the books of the lessee. In the case of Air Seychelles, should the ownership of the aircraft pass onto the company at the end of the lease period, the treatment as per the Air Seychelles Annual Report 2005 – 2006 is correct. However, as per the arguments above, it should be treated as an operating lease. This means that all lease payments are an expense. The expenses should be written-off in the profit and loss account. In these circumstances Air Seychelles is not making a profit. It is making exorbitant losses. In conclusion we quote the Equipment Leasing Association (USA):

"Lessees do not capitalize the equipment under lease because they do not own the property … For the lessee to capitalize the equipment it does not own would be a misrepresentation. (U.S. GAAP requires detailed disclosure of lease terms including duration, obligations, options and any guarantees).”