NOUVOBANQ IGNORES OMBUDSMAN’S APPEAL

The State owned Seychelles Mercantile Banking Corporation better known by its trading name Nouvobanq has ignored a ruling by two ombudsmen, in a case of two employees who resigned four years ago but whose employment benefits the bank has refused to pay. The former employees are claiming that, under Parastatal Service Orders brought into force in 1994 by President Rene, they were entitled to payment of gratuity as they had worked with the bank for over 14 years.

The issue was the subject of a comment by the then Ombudsman, now a Judge of the Supreme Court, Mr Bernadin Renaud, in his annual report for 2002. In his report submitted to the National Assembly dominated by the SPPF, Judge Renaud said “the Management of the bank is arguing that the Public Authority is not a parastatal organisation, hence not subject to Parastatal Orders and other government conditions of employment – e.g. gratuity for past years of continuous service. If this case is not resolved soon it will be laid before the National Assembly”. The current ombudsman Mr Gustave Dodin has also taken up the issue in its report covering 2004-5. It appears that the bank has no intention of paying up, despite the pleas from the aggrieved ex-employees who have even written to President Michel. They fear that once the bank is privatised they will have no recourse.

Nouvobanq has reported profits of over SR 56 million for the year 2005 and declared dividends of SR 35 million, which mostly went to the Government which holds 78% of the shares. The bank also paid SR 21 million in business tax. The only other shareholder of Nouvobanq is the Standard Chartered Banking Corporation, a British owned bank, which used to open a branch in Seychelles at Kingsgate House, but decided in the late eighties to close it down.

The decision of Standard Chartered to close its branch in Seychelles happened to coincided with the closure of the Bank of Credit and Commerce International (BCCI) by the Bank of England in 1990, accused of international fraud and money laundering. In Seychelles BCCI had a branch in Victoria House where Nouvobanq is currently located. Following the Bank of England’s decision, the Central Bank also decided to close down the BCCI branch in Seychelles to the consternation of its depositors – who appealed to President Rene, who was at the time on holiday in Malaysia from where he ordered the branch reopened. But to prevent a run on the bank depositors were reassured that the Central Bank would guarantee to pay back funds to all depositors.

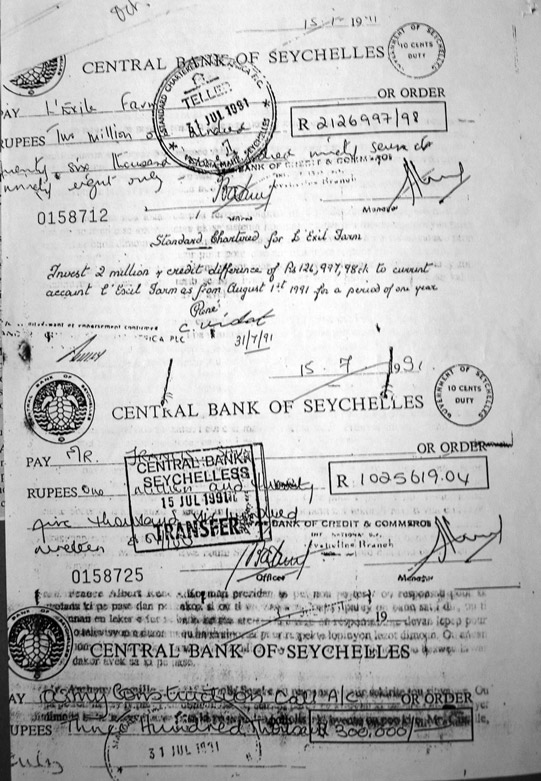

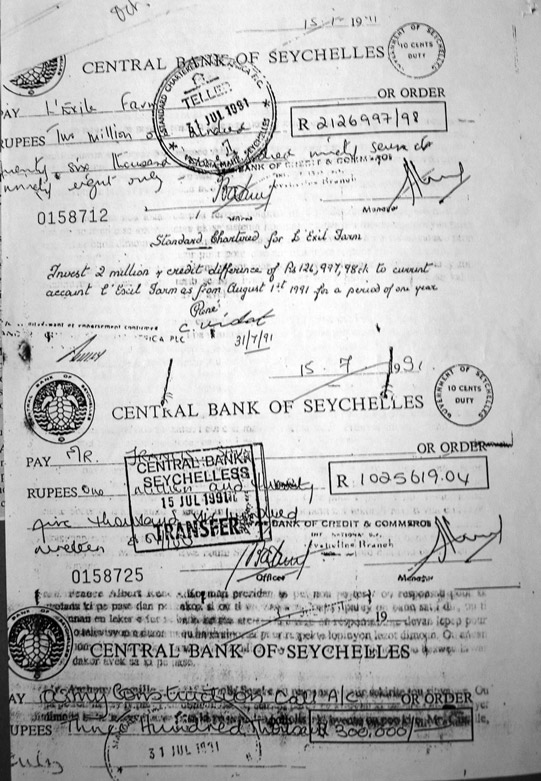

One of the depositors who had plenty of money in the BCCI was 20 year old Francis Savy who was refunded SR 1,025,619. 04 by the Central Bank. Another depositor, under the name of l’Exile Farm also had substantial sums in the BCCI in an account known as l’Exile Farm account. It was refunded SR 2,126,997.98 by the Central Bank. The signatory of the account, it appears, was Claude Vidot – then a Colonel in the Seychelles Peoples Defence Forces.

Nouvobanq claims to be the biggest bank in Seychelles based on deposit volume. However, only 32% of its deposits are in loans and advances. The rest are “investments” in government securities. As a result a substantial source of its SR 66 million profits comes from Government who is its biggest shareholder. Nouvobanq is also the only financial institution allowed by the Central Bank to keep a large amount of depositors funds in the form of deposits in another bank (10%). The beneficiary of the “largess” is the Seychelles Savings Bank (SSB) which is entirely owned by the Government and virtually managed by the Central Bank.

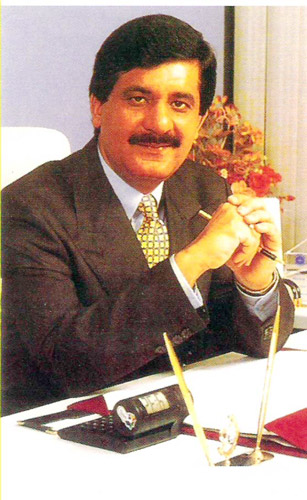

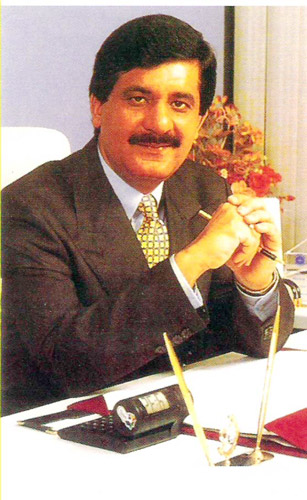

Since its creation, Nouvobanq has been managed by Ahmed Saeed. Mr Saeed, a Pakistani national, who was the last manager of the BCCI branch in Seychelles. He resigned from the BCCI shortly before it was shut down by the Central Bank, to take up a post as an advisor to the Central Bank. In 2005 his salary package at Nouvobanq was SR 374,316 which is 89% of the emoluments of all the directors of the bank. The bank paid wages and salaries to staff of SR 4,372,203 in 2005 as well as SR 434,449 of perks defined as “other staff costs”. Mr Saeed is provided with a house, a car, private school for his children as well as holidays abroad, according to our information. In 2005 Nouvobanq paid out SR 410,000 in compensation to employees for length of service.

It remains to be seen if the Ombudsman will finally take Nouvobanq to court – as it is empowered to do by the Constitution so that the two aggrieved former employees will get justice. Perhaps it will only happen when the opposition takes control of the National Assembly later this year, unless President Michel decides to mention this small matter in his state of the nation address, alongside why Nouvobanq has not yet been privatised.