FOREIGN DIRECT INVESTMENTS (FDI)

Are the benefits being exaggerated?

President James Michel never misses a moment to sell the notion that, because the tourism industry is attracting an inordinate amount of interests from potential foreign investors, the economy is getting along well. The two are not mutually exclusive.

Just-finished MAIA Luxury hotel

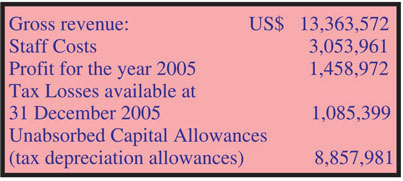

A close look at the financial statement of one five star resort operating in Seychelles – The Banyan Tree (the establishment often referred to by Government as a model of Investment in the Tourism Industry) - in respect of the year ended 31 December 2005 reveal some interesting facts and figures which puts in stark perspective the true benefits to the country and the government of the recent approved FDIs.

Indebtedness secured by mortgage or other charges in favour of Barclays Bank (

Table 1

On the basis that the resort paid 7% GST on its gross revenue, Seychelles Government received in taxes the gross sum of US$ 875,000 in total for the year.

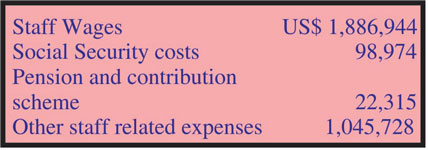

Under staff cost, the hotel discloses the following:

Table 2

Assuming that the hotel’s social security contribution is for local staff only and that it represents the concessionary minimum of 15% of gross wages of employees which employers are obliged to pay to the Social Security Fund, contribution payable the local staff salaries amounted to a mere sum of US$ 658,000.

On the basis that the company manages to carry on generating profits of US$ 1,450,000 each year, it will take over 6 years before it wipes out its tax losses and available tax depreciation allowances. This means government will not benefit from any business tax from this investment for the next 6 years.

Further more, the foreign investor has a charge on its assets in

An interesting note to the financial statement reads (12 (v) ) “ cash lien over the Credit

Foreign investors in the tourism sector operate entirely in foreign currency, hence creating a two tract economy. One, the FDI economy, operates under minimum regulations and enjoys a seamless connection with the global economy through hard currency transactions and retentions and employs any number of foreign workers at a reduced work permit fees. The other, the old economy is hampered by licensing regulations, bureaucracy, poor quality workforce, and an employment law which places onus on the employer to, not only pay a graduating social security tax, but also compensation if the employee decides to leave his or her employ without reason.

In the old economy a business cannot go bankrupt unless permitted by the government to do so. In the old economy too a license is issued to the business operator not the business. If a business changes hands it must apply afresh for a new license. If a company changes ownership in the old economy it must pay compensation to its workers even if the new owner continues to employ the same workers. In the FDI economy, government pays the workers compensation on behalf of the new owners out of public funds (Indian Ocean Tuna). In the FDI economy, such as the Fisherman’s Cove Hotel, ownership is changed simply by selling the BVI or

The old economy cannot do business with the FDI economy in foreign currency. The former must charge for its services in local currency which cannot be readily converted into foreign currency to pay for machinery, equipment and raw materials. To pay for services and goods from the Old Economy, the FDI economy must convert its foreign currencies at the official rates while the Old Economy must convert its local currency at parallel market rate, which is two times the official rate, in order to be able to replenish stocks. As a consequence, services offered by the Old Economy are seen to be uncompetitive in the FDI economy. The same problem arises with the workforce.

A qualified Seychellois with domestic residency must be paid in local currency (which the investor obtains through the banking system at the official rate of exchange). As a result local workforce in the FDI economy is seen to be expensive relative to foreign workers of the same skills. The FDI absorbs almost all the local living costs of the expatriate staff and pay net wages. The local employees pay for all their living costs subjected to high inflation out of their wages in hard curency overseas. Many of the foreign workers come from countries where the exchange rate is very favourable and the cost of living merely a fraction of that of

Petit Anse Hotel under construction

Foreign Investors Officials even collude with to by-pass foreign exchange and investment regulations designed to “attract” foreign exchange into the local banking system. For example, the Supa Save Supermarket, which opened its doors just before the election campaign started, is owned by a supermarket chain based in

Foreign Investors are not encouraged to join or actively take part in the Seychelles Chamber of Commerce and Industry (SCCI), the only organised representative body in the private sector, or contribute to it. In fact they are deliberately discouraged from having anything to do with the long-established local business organisation. Foreign Investors get access directly to State House or the Ministry of Finance to sort out any individual problems, such as work permits or customs problems. It took the elected chairman of the SCCI nearly one year before he could get an audience with President Michel and the Governor of the Central Bank. The SCCI is not represented in President Michel’s National Economic Council. But the FDI economy is well represented by a director of Banyan Tree.

The two tract economy, however, is working to undermine the macro economy. Not only do the revenues of the FDI, in foreign currency, not circulate in the old economy to create added values, but each rupee of local currency expenditures they make generate at least four times its value in terms of demand for foreign exchange. This additional demand for foreign exchange is not met from the foreign exchange from which it comes, since it has been used to pay arrears, but from speculative transfers of new foreign exchange which come in to make fat profits – such as in land transactions. These speculative transactions generate more local currencies which create new demands for foreign exchange.

In effect FDI adds to the self perpetuating cycle of demand for foreign exchange which increases the total amount of local currency in circulation. This effect is revealed in the Central Bank’s own statistics. At the end of October 2005, the monetary measure called broad money (all the money deposited with the banks, as well as at the Central Bank plus currency in circulation) was SR 4,256 million. But at the end of October this year, it had risen to SR 4,674 – even though the Ministry of Finance is claiming that the budget was in surplus – which if the money was not spent, should have reduced the amount of money in circulation. Foreign currency deposits of FDI in the local banks are not counted as money in circulation. It cannot be borrowed by rupee holders for investments, unless the investment generates foreign currency, or for working capital.

In

FDI contributes nothing directly to the training of skills in the tourism labour force. In

Roads in poor state of disrepair

Unless a major restructuring of the economy is undertaken – with the currency convertibility being at the forefront – the